The automotive industry has undeniably been shaken up over the last 18 months. Some businesses are booming and some are slowing down, but the one constant aspect here is change.

Likewise, there have been big changes in the realm of payment processing over the past decade. The responsibility of processing fees no longer needs to rest solely on the merchant’s shoulders. In 2013, following a prolonged legal battle between merchants and credit card associations, a settlement was reached that allows merchants to pass a portion of fees incurred onto customers in the United States*.

Surcharges have been around for a long time. Oftentimes, they appear on hotel bills or when purchasing tickets for events. Gas stations in Michigan typically charge an additional 10 cents per gallon when customers pay with a credit card. Even fast-food restaurants have begun to utilize this option.

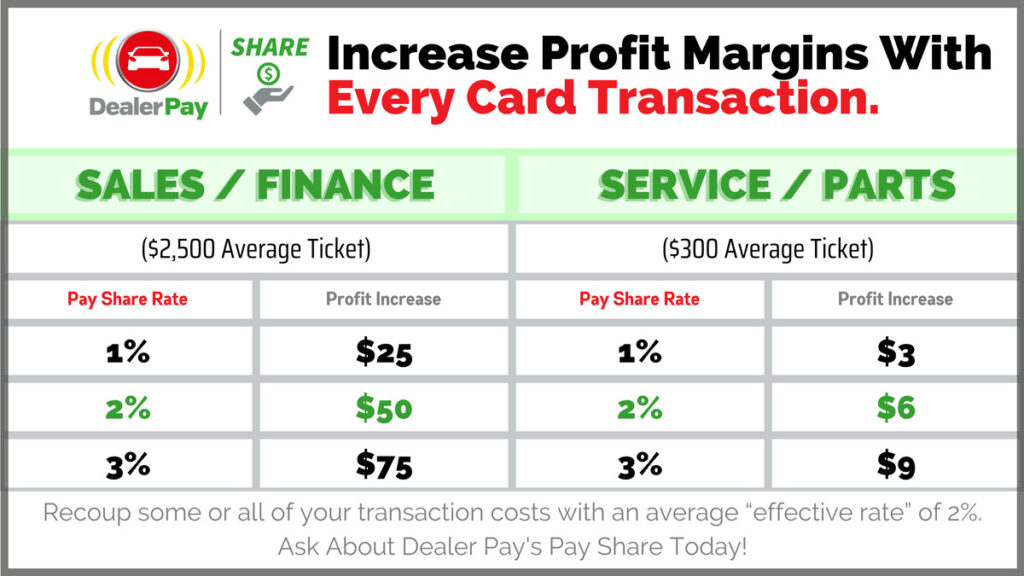

What does this mean for the automotive industry? Dealer Pay designed a program called Pay Share that allows the merchant to share up to 3% of the total transaction, to cover processing costs. This allows merchants to accept credit card payments for much higher amounts, with the assurance that this structure will reimburse the merchant for fees incurred on such a transaction. The percentage is flexible to meet not only the needs of the merchant but to keep customers satisfied as well.

Dealer Pay works with dealerships across the country that have begun taking advantage of this program. Many clients choose to share a higher percentage for sales, but a lower percentage for fixed ops. This allows larger purchases on a credit card so the customer can earn points or miles. One dealership in Iowa started this program on 12/15/2020, strictly in their sales and finance departments, at a 2% pay share rate. As of 12/31/2020, they had already saved over $3200! How much could your dealership save?

Dealer Pay offers a proprietary software specifically designed for dealerships. This software incorporates reporting functions, Pay Share, and everyday processing into one easy-to-use system, offering up to five times more ways to pay, secure payment links, hands-on personal support during ALL business hours, and several contactless payment options. Dealer Pay always offers a free consultation, side-by-side cost analysis, and demonstration, either virtually or in person. Reach out to Dealer Pay today to see how we can not only increase your bottom line, but create a lasting partnership on your road to success.

*Not legal in Connecticut, Kansas, Maine, and Massachusetts